|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Subprime Home Lenders: A Comprehensive GuideWhat Are Subprime Home Lenders?Subprime home lenders are financial institutions that provide loans to borrowers with less-than-perfect credit scores. These lenders cater to individuals who may not qualify for traditional loans due to their credit history. How Subprime Lending WorksSubprime loans typically come with higher interest rates to compensate for the increased risk taken by the lender. Borrowers are often required to provide more documentation and might face stricter terms. Key Features of Subprime Loans

Pros and Cons of Subprime LoansAdvantages

Disadvantages

Alternatives to Subprime LendingFor those exploring other options, considering va loan lenders can be beneficial. VA loans are designed for veterans and offer competitive rates. Managing Subprime LoansIt is crucial for borrowers to carefully assess their financial situation before committing to a subprime loan. Creating a realistic budget and exploring resources like current fixed heloc rates can aid in better financial planning. FAQWhat credit score is considered subprime?A subprime credit score is typically below 670, but criteria can vary by lender. Are subprime loans only for home purchases?No, subprime loans can also be used for refinancing and other types of credit like auto loans. Can subprime loans be refinanced?Yes, borrowers can refinance subprime loans to potentially obtain better terms as their credit improves. https://migonline.com/bad-credit

If your FICO score is less than 600, it may be difficult for lenders to give you a home loan; but this does not mean you cannot get a mortgage. https://www.huduser.gov/portal/datasets/manu.html

HUD has annually identified a list of lenders who specialize in either subprime or manufactured home lending for over ten years. Beginning with 2004 HMDA ... https://dreamhomefinancing.com/subprime-mortgage-lenders.aspx

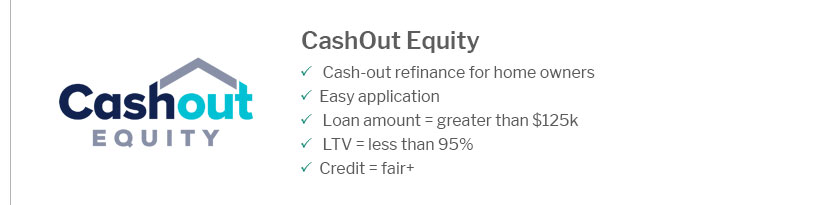

Below is a list of the top subprime mortgage lenders in no particular order. Between them all, we can help you with your loan no matter what it is and in any ...

|

|---|